Wisconsin Property Tax Vs Illinois . does illinois or wisconsin have lower property taxes? an effective property tax rate is the annual property tax payment as a percentage of home value. if you are considering a real estate search, you’ll want to think about the location’s property taxes since they add to your homeownership costs. Median real estate tax paid: Wisconsin ranks 18th in the country for its median property taxes,. In the table below, you will find average effective. Illinois has an average property tax rate of 1.78%. how do wisconsin's property tax costs compare to other states? in order to help, we put together a full breakdown of the property tax rates, and property tax amount paid, in all 50. 52 rows each of the 50 states has its own tax system that's completely separate from the federal tax system that. the median property tax in wisconsin is $3,007.00 per year for a home worth the median value of $170,800.00. wisconsin property tax rate.

from www.illinoispolicy.org

Wisconsin ranks 18th in the country for its median property taxes,. the median property tax in wisconsin is $3,007.00 per year for a home worth the median value of $170,800.00. wisconsin property tax rate. in order to help, we put together a full breakdown of the property tax rates, and property tax amount paid, in all 50. if you are considering a real estate search, you’ll want to think about the location’s property taxes since they add to your homeownership costs. In the table below, you will find average effective. does illinois or wisconsin have lower property taxes? Illinois has an average property tax rate of 1.78%. Median real estate tax paid: 52 rows each of the 50 states has its own tax system that's completely separate from the federal tax system that.

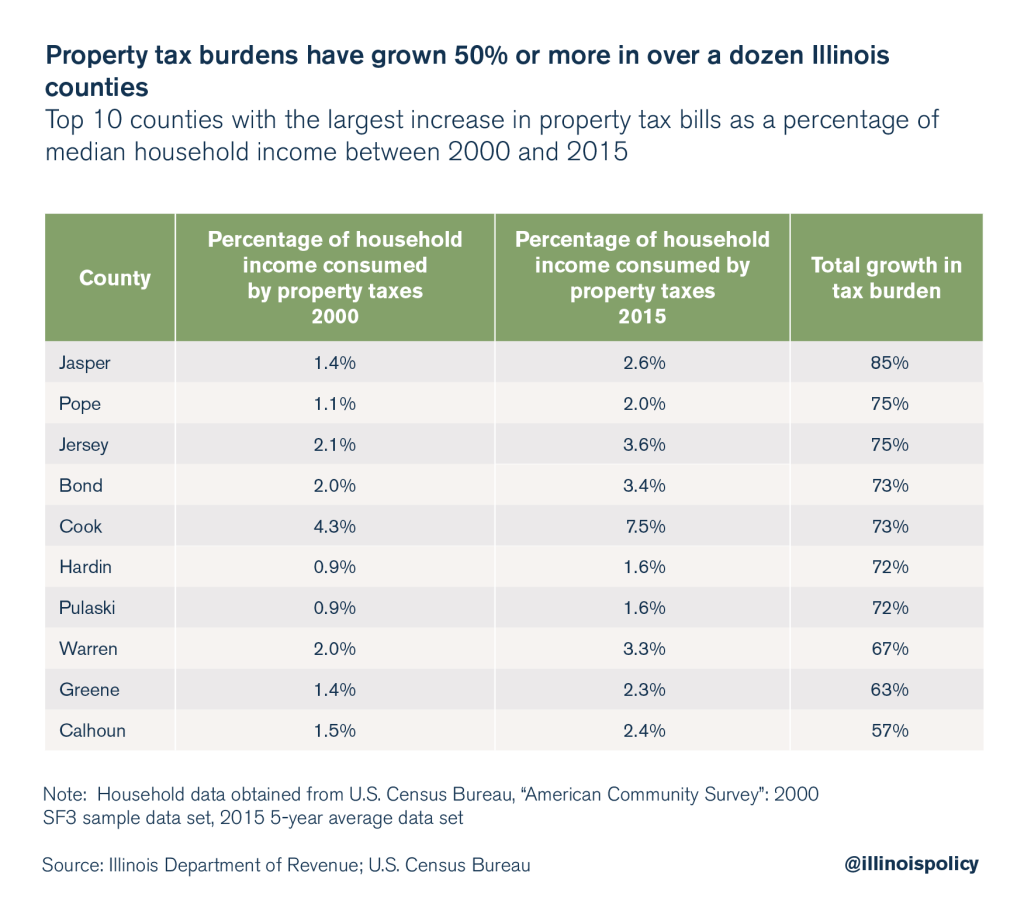

Property taxes grow faster than Illinoisans’ ability to pay for them

Wisconsin Property Tax Vs Illinois wisconsin property tax rate. an effective property tax rate is the annual property tax payment as a percentage of home value. Illinois has an average property tax rate of 1.78%. 52 rows each of the 50 states has its own tax system that's completely separate from the federal tax system that. In the table below, you will find average effective. the median property tax in wisconsin is $3,007.00 per year for a home worth the median value of $170,800.00. if you are considering a real estate search, you’ll want to think about the location’s property taxes since they add to your homeownership costs. in order to help, we put together a full breakdown of the property tax rates, and property tax amount paid, in all 50. does illinois or wisconsin have lower property taxes? how do wisconsin's property tax costs compare to other states? Median real estate tax paid: wisconsin property tax rate. Wisconsin ranks 18th in the country for its median property taxes,.

From www.illinoispolicy.org

Property taxes grow faster than Illinoisans’ ability to pay for them Wisconsin Property Tax Vs Illinois 52 rows each of the 50 states has its own tax system that's completely separate from the federal tax system that. Illinois has an average property tax rate of 1.78%. how do wisconsin's property tax costs compare to other states? the median property tax in wisconsin is $3,007.00 per year for a home worth the median value. Wisconsin Property Tax Vs Illinois.

From www.xoatax.com

Wisconsin Property Tax How it works? Wisconsin Property Tax Vs Illinois Median real estate tax paid: Illinois has an average property tax rate of 1.78%. if you are considering a real estate search, you’ll want to think about the location’s property taxes since they add to your homeownership costs. 52 rows each of the 50 states has its own tax system that's completely separate from the federal tax system. Wisconsin Property Tax Vs Illinois.

From paulsnewsline.blogspot.com

Retiring Guy's Digest Current Market Value of All Taxable Property in Wisconsin Ends 5year Slide Wisconsin Property Tax Vs Illinois Median real estate tax paid: if you are considering a real estate search, you’ll want to think about the location’s property taxes since they add to your homeownership costs. how do wisconsin's property tax costs compare to other states? an effective property tax rate is the annual property tax payment as a percentage of home value. . Wisconsin Property Tax Vs Illinois.

From states.aarp.org

Wisconsin State Taxes 2023 Property and Sales Wisconsin Property Tax Vs Illinois 52 rows each of the 50 states has its own tax system that's completely separate from the federal tax system that. if you are considering a real estate search, you’ll want to think about the location’s property taxes since they add to your homeownership costs. an effective property tax rate is the annual property tax payment as. Wisconsin Property Tax Vs Illinois.

From www.thestreet.com

These States Have the Highest Property Tax Rates TheStreet Wisconsin Property Tax Vs Illinois the median property tax in wisconsin is $3,007.00 per year for a home worth the median value of $170,800.00. Wisconsin ranks 18th in the country for its median property taxes,. how do wisconsin's property tax costs compare to other states? Median real estate tax paid: wisconsin property tax rate. does illinois or wisconsin have lower property. Wisconsin Property Tax Vs Illinois.

From www.illinoispolicy.org

Property taxes grow faster than Illinoisans’ ability to pay for them Wisconsin Property Tax Vs Illinois if you are considering a real estate search, you’ll want to think about the location’s property taxes since they add to your homeownership costs. wisconsin property tax rate. how do wisconsin's property tax costs compare to other states? In the table below, you will find average effective. Median real estate tax paid: 52 rows each of. Wisconsin Property Tax Vs Illinois.

From dxobnbzak.blob.core.windows.net

Wi Property Tax Rate at Trevor Smith blog Wisconsin Property Tax Vs Illinois Median real estate tax paid: wisconsin property tax rate. 52 rows each of the 50 states has its own tax system that's completely separate from the federal tax system that. In the table below, you will find average effective. an effective property tax rate is the annual property tax payment as a percentage of home value. Wisconsin. Wisconsin Property Tax Vs Illinois.

From www.illinoispolicy.org

Illinois is a hightax state Illinois Policy Wisconsin Property Tax Vs Illinois how do wisconsin's property tax costs compare to other states? does illinois or wisconsin have lower property taxes? 52 rows each of the 50 states has its own tax system that's completely separate from the federal tax system that. Median real estate tax paid: Illinois has an average property tax rate of 1.78%. Wisconsin ranks 18th in. Wisconsin Property Tax Vs Illinois.

From skydanequity.com

How to Resolve Your Struggle With Illinois Property Taxes SkyDan Equity Partners Wisconsin Property Tax Vs Illinois does illinois or wisconsin have lower property taxes? In the table below, you will find average effective. 52 rows each of the 50 states has its own tax system that's completely separate from the federal tax system that. how do wisconsin's property tax costs compare to other states? in order to help, we put together a. Wisconsin Property Tax Vs Illinois.

From my-unit-property-9.netlify.app

Real Estate Property Tax By State Wisconsin Property Tax Vs Illinois if you are considering a real estate search, you’ll want to think about the location’s property taxes since they add to your homeownership costs. in order to help, we put together a full breakdown of the property tax rates, and property tax amount paid, in all 50. the median property tax in wisconsin is $3,007.00 per year. Wisconsin Property Tax Vs Illinois.

From gustancho.com

Illinois Rising Property Taxes Are Forcing Homeowners To Flee State Wisconsin Property Tax Vs Illinois does illinois or wisconsin have lower property taxes? Wisconsin ranks 18th in the country for its median property taxes,. Illinois has an average property tax rate of 1.78%. the median property tax in wisconsin is $3,007.00 per year for a home worth the median value of $170,800.00. in order to help, we put together a full breakdown. Wisconsin Property Tax Vs Illinois.

From www.fausettlaw.com

Illinois Has Second Highest Property Taxes How Are They Calculated? Wisconsin Property Tax Vs Illinois 52 rows each of the 50 states has its own tax system that's completely separate from the federal tax system that. Wisconsin ranks 18th in the country for its median property taxes,. Median real estate tax paid: in order to help, we put together a full breakdown of the property tax rates, and property tax amount paid, in. Wisconsin Property Tax Vs Illinois.

From taxfoundation.org

Wisconsin Tax Reform Options to Improve Competitiveness Wisconsin Property Tax Vs Illinois the median property tax in wisconsin is $3,007.00 per year for a home worth the median value of $170,800.00. wisconsin property tax rate. In the table below, you will find average effective. if you are considering a real estate search, you’ll want to think about the location’s property taxes since they add to your homeownership costs. Illinois. Wisconsin Property Tax Vs Illinois.

From marylynnewzita.pages.dev

Illinois Property Tax Increase 2024 Casie Cynthia Wisconsin Property Tax Vs Illinois Illinois has an average property tax rate of 1.78%. an effective property tax rate is the annual property tax payment as a percentage of home value. wisconsin property tax rate. Wisconsin ranks 18th in the country for its median property taxes,. the median property tax in wisconsin is $3,007.00 per year for a home worth the median. Wisconsin Property Tax Vs Illinois.

From learn.roofstock.com

U.S. cities with the highest property taxes Wisconsin Property Tax Vs Illinois does illinois or wisconsin have lower property taxes? how do wisconsin's property tax costs compare to other states? in order to help, we put together a full breakdown of the property tax rates, and property tax amount paid, in all 50. the median property tax in wisconsin is $3,007.00 per year for a home worth the. Wisconsin Property Tax Vs Illinois.

From dxonihyoc.blob.core.windows.net

Illinois Property Tax Vs Wisconsin at John Boatman blog Wisconsin Property Tax Vs Illinois in order to help, we put together a full breakdown of the property tax rates, and property tax amount paid, in all 50. if you are considering a real estate search, you’ll want to think about the location’s property taxes since they add to your homeownership costs. the median property tax in wisconsin is $3,007.00 per year. Wisconsin Property Tax Vs Illinois.

From wirepoints.org

20 facts every Illinoisan should know about the progressive tax amendment Wirepoints Special Wisconsin Property Tax Vs Illinois if you are considering a real estate search, you’ll want to think about the location’s property taxes since they add to your homeownership costs. in order to help, we put together a full breakdown of the property tax rates, and property tax amount paid, in all 50. Median real estate tax paid: does illinois or wisconsin have. Wisconsin Property Tax Vs Illinois.

From www.illinoispolicy.org

Illinois homeowners pay the secondhighest property taxes in the U.S. Wisconsin Property Tax Vs Illinois wisconsin property tax rate. Median real estate tax paid: Wisconsin ranks 18th in the country for its median property taxes,. does illinois or wisconsin have lower property taxes? 52 rows each of the 50 states has its own tax system that's completely separate from the federal tax system that. In the table below, you will find average. Wisconsin Property Tax Vs Illinois.